Lithium Battery Recycling Machine Cost is often the primary concern for businesses exploring this essential, sustainable venture. Understanding the investment required goes far beyond a simple price tag.

Understanding the Price Spectrum: What Drives Lithium Battery Recycling Machine Cost?

Expect a wide range, typically from $100,000 USD for basic pilot-scale or small manual lines to $5 million USD+ for large-scale, fully automated plants with advanced hydrometallurgical refining. Key cost drivers include:

1. Capacity & Scale

Small-scale (100-500 kg/day): Ideal for pilot projects, research, or niche recyclers. Costs: $100,000 – $500,000.

Medium-scale (1-5 tons/day): Suitable for regional recyclers or specialized facilities. Costs: $500,000 – $2 million.

Large-scale (10+ tons/day): Designed for major recycling hubs or integrated waste management. Costs: $2 million – $5 million+.

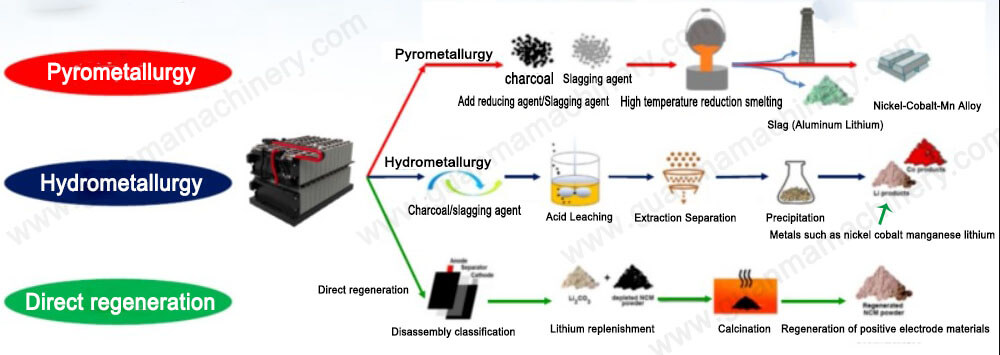

2. Technology & Process Route

Mechanical Processing Only (Shredding, Crushing, Sorting): Lower initial cost ($100k – $800k), suitable for black mass production. Limited revenue potential.

Mechanical + Pyrometallurgy: Higher capex ($1m – $3m+), energy-intensive, recovers alloys but loses lithium/critical minerals. Faces increasing ESG scrutiny.

Mechanical + Hydrometallurgy: Growing preference for sustainable battery recycling. Higher capex ($1.5m – $5m+), but recovers high-purity cathode materials (Li, Co, Ni, Mn) with better value recovery and lower emissions. Involves leaching, solvent extraction, precipitation.

Direct Recycling: Potentially lower energy/cost long-term, but less commercially mature.

3. Level of Automation

Manual/Semi-Automated: Lower initial cost, higher labor costs, safety risks, lower consistency.

Fully Automated: Higher capex, lower operating costs, improved safety, higher throughput consistency, essential for large scale. Crucial for handling end-of-life EV batteries safely.

4. Machine Quality & Origin

Established Brands: Higher initial cost ($1m+ for medium lines), premium engineering, strong after-sales, compliance assurance.

Reputable Chinese Manufacturers: Competitive pricing (often 20-40% lower), rapidly improving quality, increasingly robust support. Dominant for mid-market.

Budget Options (Risky): Significantly lower quotes exist but carry risks: poor safety, low efficiency, unreliable components, limited support, potential non-compliance.

5. Safety & Environmental Compliance

Non-negotiable investment area. Costs cover:

Explosion-proof design (shredders, conveyors in nitrogen atmosphere).

Advanced gas treatment systems (scrubbers, filters for HF, VOCs).

Effluent treatment plants (chemical neutralization, heavy metal removal).

Dust collection systems.

Fire suppression systems.

Certifications (CE, local environmental permits).

Ignoring this drastically increases long-term risk and cost.

6. Scope of Supply & Integration

Basic Machine Package: Core processing units only.

Turnkey Plant: Includes engineering, installation, commissioning, training, automation controls, utilities hookup, environmental systems. Significantly higher cost but ensures operational success. Essential for complex hydrometallurgical lines.

Beyond the Machine Price: Hidden & Ongoing Costs

Site Preparation: Foundation, utility upgrades (high power, water, gas), ventilation.

Installation & Commissioning: Can be 10-20% of machine cost.

Spare Parts & Consumables: Regular replacement of shredder hammers, sieves, filter elements, chemical reagents.

Labor: Skilled operators, maintenance technicians, safety officers.

Energy: Significant, especially for pyrolysis or large shredding/hydromet operations.

Waste Disposal: Costs for non-recyclable fractions or hazardous residues (if not fully processed).

Maintenance Contracts: Recommended for complex systems.

Permitting & Regulatory Fees: Ongoing compliance costs.

Feedstock Logistics & Pre-treatment: Collection, transportation, discharge state handling.

Calculating ROI: Making the Investment Pay

The Lithium Battery Recycling Machine Cost must be justified by revenue streams:

Black Mass Sales: Lower value, market price fluctuates.

Recovered Metal Sales (Ni, Co, Cu, Mn): Higher value than black mass.

High-Purity Lithium Salts (e.g., Li2CO3, LiOH): Highest value, achievable via hydrometallurgy. Critical for critical mineral recovery strategies.

Recycling Fees/Subsidies: Government incentives or producer responsibility schemes.

Brand Value & ESG Credentials: Meeting sustainability goals.

Key ROI Factors:

Feedstock Cost & Composition: Securing low-cost/high-value feedstock (e.g., EV battery packs) is crucial.

Metal Recovery Rates & Purity: Directly impacts revenue. High-efficiency hydromet systems win long-term.

Operational Efficiency (Opex): Minimizing labor, energy, reagent, and waste disposal costs.

Market Prices for Outputs: Volatile, requires hedging or long-term contracts.

Plant Utilization Rate: Maximizing throughput is key.

Strategic Investment Tips:

Define Your Niche: Target specific feedstock (consumer electronics, EV, manufacturing scrap) to optimize machine design/cost.

Prioritize Core Technology: Invest in efficient, safe core processes (shredding under inert gas, effective separation, high-yield hydromet) even if initial cost is higher.

Demand Transparency: Get detailed quotes breaking down equipment, installation, commissioning, and support costs.

Evaluate Total Cost of Ownership (TCO): Model 5-10 years of opex (energy, labor, maintenance, consumables) against revenue.

Verify Compliance & Safety: Ensure equipment meets stringent international standards (CE, ATEX, UL) and local environmental regulations. Non-compliance costs far exceed initial savings.

Check After-Sales & Local Support: Availability of spare parts, technical expertise, and service engineers is critical for uptime and ROI. Consider closed-loop recycling partnerships for secure feedstock and offtake.

Explore Financing & Incentives: Government grants, green loans, or supplier financing may be available.

An Investment in Sustainability & Profitability

Lithium Battery Recycling Machine Cost represents a significant but increasingly essential investment driven by the surge in EV battery waste, resource scarcity, and circular economy regulations. While initial capex ranges widely ($100k to $5m+), focusing solely on sticker price is misleading. A thorough analysis of technology, capacity, automation, safety compliance, and crucially, long-term ROI based on recovered material value and operational efficiency is paramount. Investing in the right technology (especially efficient hydrometallurgy) and a reputable supplier offering robust support ensures your recycling operation is not only environmentally responsible but also economically viable for the long haul.

Ready to evaluate your specific Lithium Battery Recycling Machine Cost and ROI? Contact our experts for a customized assessment and technology recommendation.